Mortgage Rates Drop

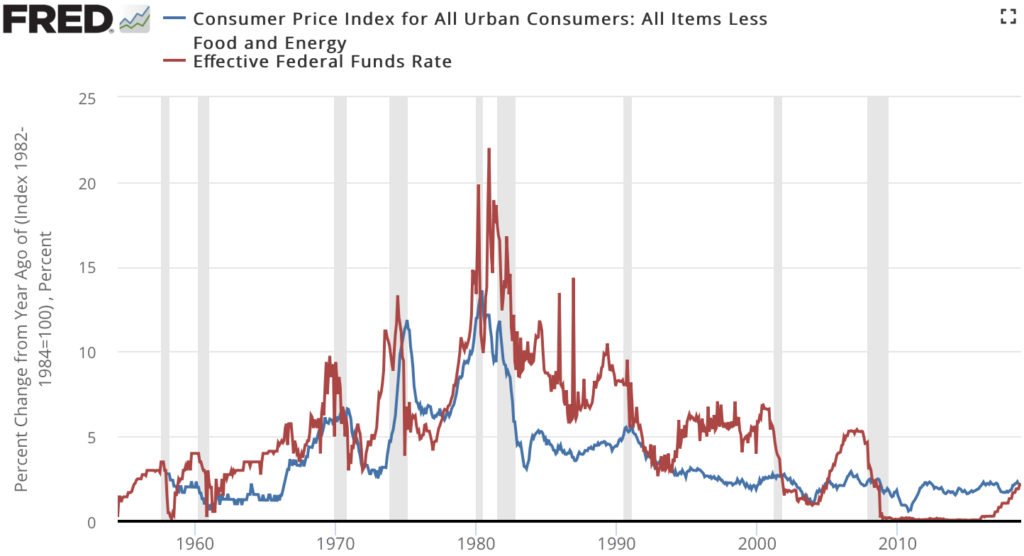

The Federal Reserve has always controlled inflation and recession by increasing or decreasing basis points. Mortgage lenders adjust their interest rates accordingly, and because of the expected increases, 2022 has witnessed the largest short-term interest rate increases since 1981.

In the last week, however, interest rates have adjusted down. The recent spike of 50 basis points in May, and 75 basis points in June has current interest rates at 5.62%. This is down from June, where interest rates rose as high as 5.81%.

We tend to be short sighted in our historical view of what is happening with interest rates. When we look back over 5 to 10 years, interest rates over 5% may seem high. However the historical average for interest rates is 7.71%.

Historical Interest Rates

In the 1970s, interest rates were at 7.25% and grew to 12.90% by the end of the decade.

By 1981, inflation had risen to 9.5% and the Federal Reserve pushed mortgage rates up as high as 18.45%.

During the 1990’s, interest rates returned to the single digits, and many homeowners refinanced their 18% rates to 9% and were able to cut their house payments in half. Interest rates dropped as low as 7% and many homeowners refinanced multiple times.

By the 2000s, rates had moved back up to 8%. During this decade, rates dropped again into the 5% to 6% range. In 2009, interest rates even fell as low as 4.81%.

The decade of the 2010s saw interest rates drop down to 3.35% and climb no higher than 4.87%.

We have to remember that when 2020 began, interest rates dropped to all time lows because the Federal Reserve cut rates to almost 0%. This was due to the pandemic and the FED's efforts to stabilize the economy.

The 30-year rate was at an historical low of 2.68% and remained between 2.70% and 3.10%. These numbers over the last 2 decades seem to be all that we remember as we watch interest rates climb above 5%.

However, the average interest rate since 1971 has stayed just below 8%.

In January of 2022, rates were at 3.45% and had already begun an upward trend. Like 1981, the Federal Reserve moved to control inflation, which had risen to 8.5%. This is lower than the 9.5% inflation rate of 1981. Whether supply chains return to pre-pandemic levels, and prices adjust downward will determine what happens with inflation and interest rates.

Is it a Good Time to Buy a Home?

Interest rates in 2022 rose as high as 5.81% mid June and fell to 5.70% by month’s end, according to Freddie Mac. With concerns of a possible recession looming and the slowing of the housing market, rates have come down for the first time in 2022. Currently rates are at 5.62%.

Reducing inflation while avoiding a recession, means that the rate can go either way. Should interest rates rise to 6%, it is still well below the average when looking at rates over the last several decades.

As the rental market becomes more competitive with rising rents, homebuyers will still benefit by locking in a monthly payment that will remain the same over 30 years. Although we have witnessed sharp increases recently, mortgage rates remain at normal levels and are still considered historically favorable.

As interest rates rise, the cost of homeownership also rises. Because of limited supply, prices rose dramatically in the last two years. There are still more buyers than available homes for sale. Demand remains high, but rising interest rates have cooled the market. This is not a bubble bursting. It is a return to normalcy.

A one or two point change in interest rates can add up to a lot of money over 30 years and increase your monthly payment. However, experts are in concesus that trying to wait out the market can only lead to increased payments.

Home prices are not expected to drop like they did after 2008. The sales activity is slowing, due in part to reduced inventory and less buyers competing for homes. The bubble of 2008 was driven by loans being made available to people who shouldn't have qualified for a loan. Today, the underwriting process is more stringent.

It is best to consider your long term lifestyle choices when considering buying a home. Shopping among mortgage companies is also crucial in ensuring your get the lowest rate. Sales have slowed in the Lake Tahoe and Bay Area markets compared to last year. However, when you look at the sales trends over the last 10 years, inventory and sales volume are merely returning to normal levels.

I specialize in working with buyers and sellers in Incline Village, Nevada and Lake Tahoe along with buyers and sellers from the primary feeder markets in the Bay Area of California. As a Christie's Luxury Real Estate agent, I have access to unparrelelled marketing resources.

Contact me today for a free property analysis of your home, or for more information on California's premier real estate market trends.