Third Quarter Real Estate Market Report

According to a report issued by NAR, home prices rose year-over-year in 98% of metro areas in third quarter of 2022.

Single-family existing-home sales prices grew in nearly every measured metro area – 181 of 185 – compared to a year ago. The national median single-family existing-home price rose 8.6% to $398,500.

However, the monthly payment on a typical existing single-family home with a 20% down payment was $1,840 – up 50% year-over-year.

Only 46% of markets posted double-digit annual price appreciation, compared to 80% in the previous quarter.

"Much lower buying capacity has slowed home price growth and the trend will continue until mortgage rates stop rising," said NAR Chief Economist Lawrence Yun. "The median income needed to buy a typical home has risen to $88,300 – that's almost $40,000 more than it was prior to the start of the pandemic, back in 2019."

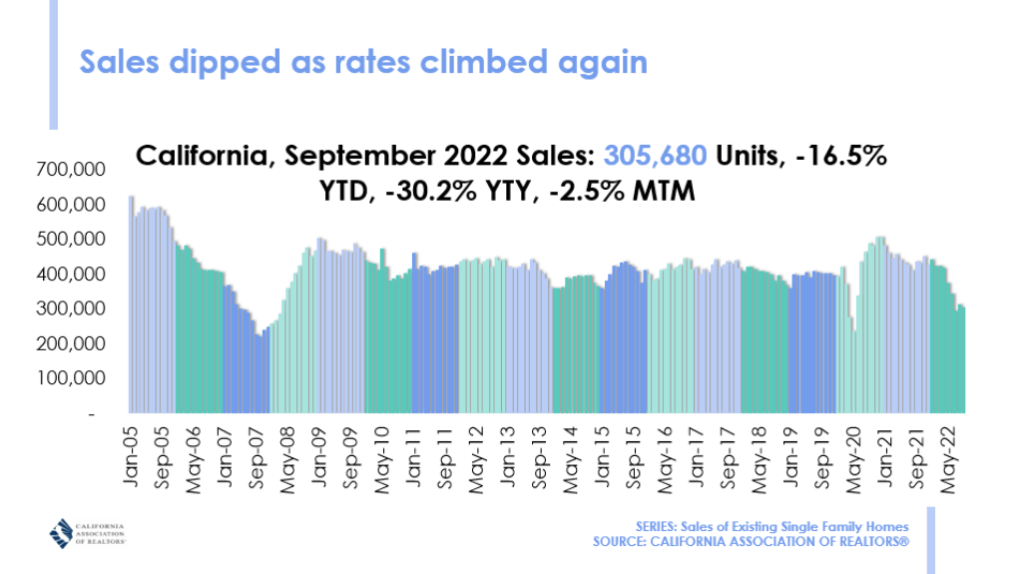

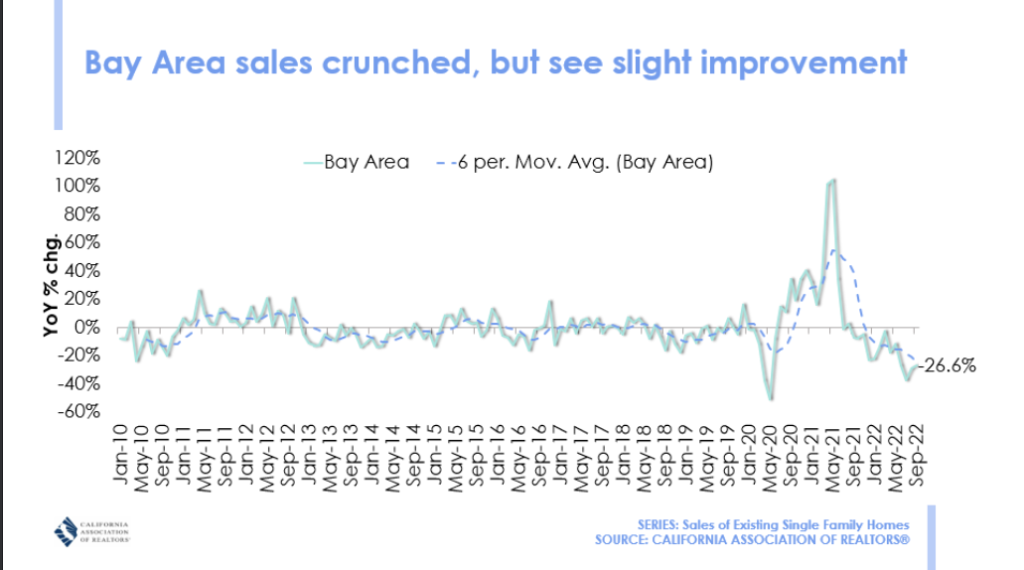

For all of Northern California, the third quarter was down 32% from last year with 11,454 homes sold. Compared to the second quarter, home sales were down 19.5%. Inventory or the number of available listings has grown 29.2% over last year. Compared to the 2nd quarter, available listings are up 25%.

Pending sales dropped 16.6% across northern California compared to last quarter. Higher interest rates have definitely contributed to a slowing in the Northern California market.

Bay Area Market Report

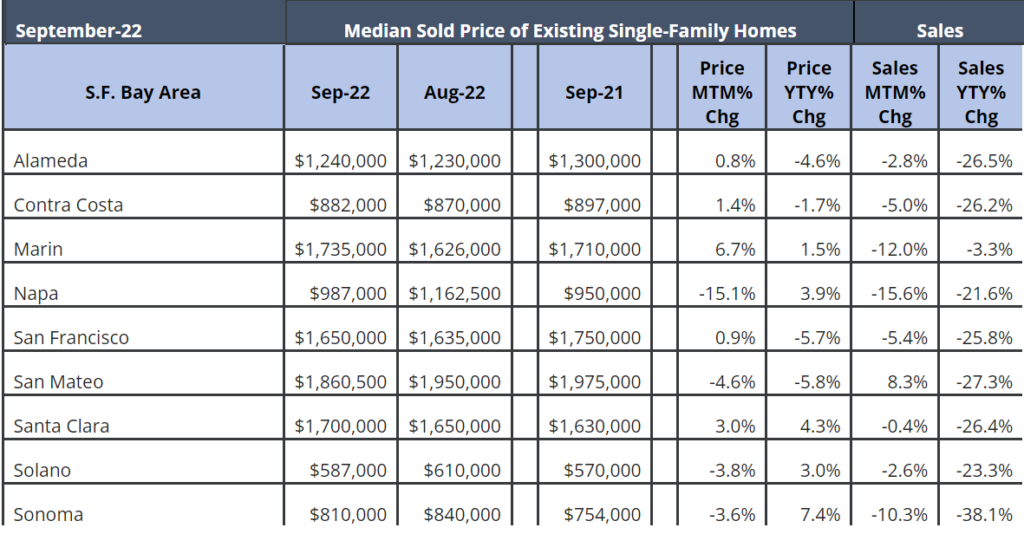

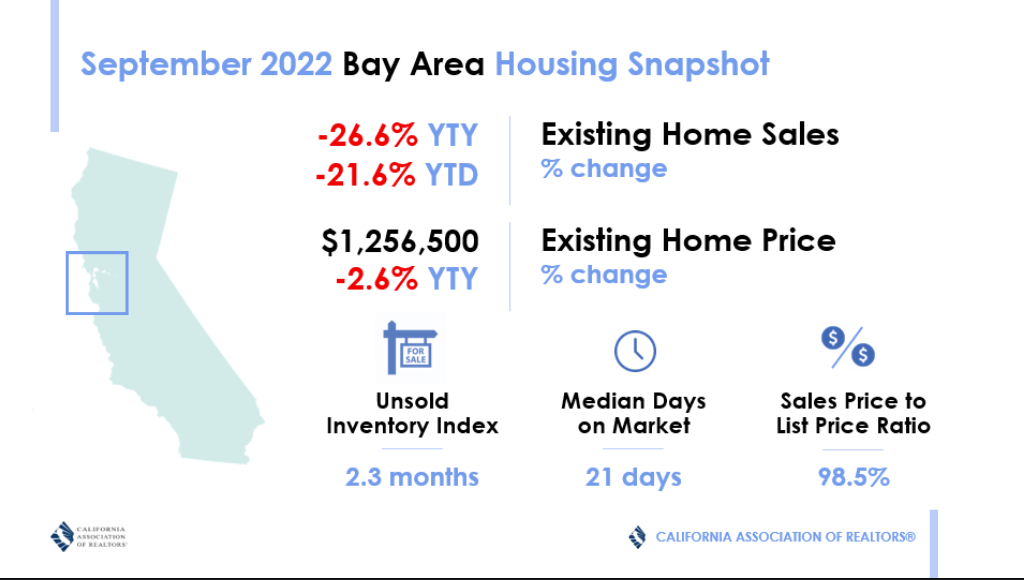

Half of the top 10 most expensive markets in the U.S. were in California. San Jose-Sunnyvale-Santa Clara had a median price of $1,688,000, or a 2.3% increase. San Francisco-Oakland-Hayward were at $1,300,000 with a 3.7% increase.

In San Mateo County, the median price is at $1,800,000 and declined 5.3% compared to last year. In Santa Crus County, median prices were at $1,250,000, up 4.1% over last year. Monterey County showed a median price of $850,000, up 3.0%.

The number of homes for sale in the Bay Area for September 2022 was at 5,798 vs 4,186 during the same period in 2021. However, the growth of new listings has slowed due to sellers not wanting to move into higher interest rates. There remains only a 3.2 month’s supply of inventory and new listings are down 20% compared to last year.

Incline Village Market

The average sale price of a home in Incline Village was $1.49M last month, up 15.8% since last year. The average sale price per square foot in Incline Village was at $723, up 2.0% since last year.

The days on market for Incline Village home sales is at 72 days, compared to 58 days last year. In September 2022, 13 homes sold, up from 8 in September of last year.

Lake Tahoe Lakefronts

The median price for all lakefronts sold was at $4,000,000 with the median price of new listings at $5,800,000. The sale to list price remains high at 91%. There are 19 active lakefront listings, with 1 sale over the last 30 days and 3 new listings.

While there is undoubtedly a slowing trend in sales across all markets, there are still many buyers waiting to see where interest rates will settle. Median prices are not adjusting down like they did in 2008. We can’t say it is a traditional buyer’s market, but sellers will need to work harder to attract buyers.

While home prices have continued to climb in the 3rd quarter, NAR predicts that the upward trend may be coming to an end. “The more expensive markets on the West Coast will likely experience some price declines following this rapid price appreciation, which is the result of many years of limited homebuilding,” Yun says.

Contact me today for more information about the real estate markets in the Bay Area and Lake Tahoe.